New Zealand’s economy continues to go from strength to strength with strong global demand for our exports, construction, healthcare, and public administration and safety the major contributors to the strength of the economy.

The housing crisis combined with the gap in international tourism remains, however according to recent trends and predictions, New Zealand has a very promising year ahead.

Regional Economic Update

Economic activity in the Manawatū region continues to strengthen, with Infometrics revealing Gross Domestic Product (GDP) increasing by 0.2% in the year to 2021 March, compared with a 3.0% fall nationally, highlighting the rapid rate of economic recovery here.

Manawatū’s strong sectors including the sizeable primary industry, coupled with low unemployment rates and the flurry of construction work all point to a prosperous future ahead.

House Prices

The Manawatū housing market is hotter than ever, experiencing a 26.3% increase in prices in the year to March 2021, outperforming the national average of 18.2%, sitting at $639,592 in March 2021, compared with $871,375 in New Zealand.

Although housing prices have risen substantially, David Klue, Branch Manager at Property Brokers Palmerston North, says it is evident the housing market has seen a shift.

“The change to taxation rules for investors has undoubtedly slowed investors down, however, the serious investor is still active and looking for opportunities. Properties on the market are taking about five working days longer to sell in the days from April 21 to 26, a reflection of a more cautious buyer deciding not to jump to put an offer in before the first open home,” says Klue.

“Typically, we are now seeing two open homes before pressure is being put on the vendors; however, almost all properties are selling in a multiple offer situation as buyers still outweigh properties on the open market,” adds Klue.

Non-residential consents reach new high

The value of non-residential building consents has surged considerably, reaching a record breaking $223.3 million during the year to March 2021, equating to a gigantic 81.9% increase from the same period last year.

One of the biggest contributors to this rise were $88m of storage building consents mainly in Palmerston North, along with some high-profile projects.

“The largest project contributing to this increase is the new Countdown Distribution Centre and secondly, the new hangers and other facilities at Ohakea, prior to the transfer to Air Force personnel to the region in 2023,” says Palmerston North City Council’s Economic Policy Advisor, Peter Crawford.

“Construction is moving fast offering confidence that we will build our way out of the economic slowdown,” adds Crawford.

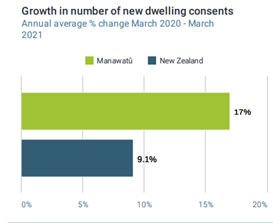

Residential consents continue to grow

Residential consents grew 17% in the March 2021 quarter, compared with 174 in the same quarter last year.

Townhouses combined with the strong growth in aged care housing are the driving force behind residential consents, with the number of townhouses approved climbing 40% over the year to March 2021.

Sara Towers, Talent and Skills Manager at CEDA, says the rapid rate of consents is a risk with the nationwide housing shortage at play.

“Although demand is high and the economy is thriving, skill shortages and supply chain delays could negatively affect the industry’s ability to meet this demand. However, the government’s housing package may take some of the heat out of house price growth that was encouraging record high consents,” explains Towers.

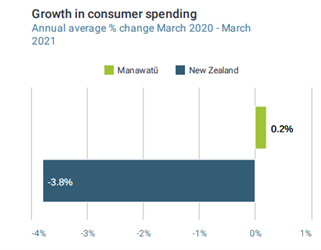

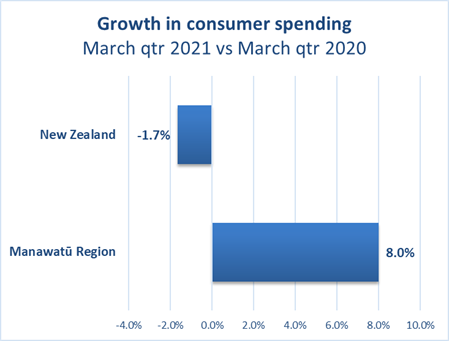

Consumer Spending

Consumer spend in the Manawatū increased by 0.2% over the year to March 2021, with top contributors including hospitality, takeaways, fuel and apparel. New Zealand, however, experienced a 3.8% plunge over the same period.

Stacey Bell, Economist for the Manawatū District Council says the March quarter signalled a strong recovery in retail spending in the region. Retail spending increased by 8.0% in the March quarter 2021 versus the March quarter 2020. This compares with a -1.7% decline in retail spending nationally over the same period.

“Central Districts Field days was a substantial driver of local spending over the March quarter compared with the March quarter 2020, when the event was cancelled. However, retail expenditure in the region has also been driven by the strong economic performance of the region over the past year relative to much of New Zealand. This has been reflected in the continued confidence of local businesses and households to continue to spend, stimulating economic activity and protecting local jobs,” says Bell.

Unemployment

Manawatū has a lower unemployment rate than that of New Zealand, sitting at 4% in March 2021, down from 4.2% 12 months earlier. “While construction businesses are struggling to find enough staff, job numbers are increasing as businesses take on more apprentices to support the growth expected in the region over the next ten years,” Crawford explains.

Tourism Spend

Manawatū’s visitor economy has weathered COVID-19 relatively well according to Infometrics latest economic report. Tourism spend in the region decreased by just 2.5% in the year to March 2021, whereas New Zealand decreased by 16.6%.

The March 2021 quarter also depicts the strong domestic market with a total of $76 million generated, an increase of 14.0% from the March 2020 quarter.

“The region’s strong focus on a diversified domestic visitor market and not having to rely on international tourism contributes to our strong market,” says CEDA’s Communications and Marketing Manager, Janet Reynolds.

“CEDA has put a strong focus on targeted marketing through digital campaigns and media partnerships to regain and grow our pre-COVID-19 visitor market mixed with the thriving calendar of events driving visitation and spend into the city and region,” adds Reynolds.

Primary Exports

Manawatū’s large food-based primary sector continues to stand strong against the economic storm due to the strength of global demand for primary exports produced in the region.

The total dairy pay out for the 2020/2021 season is expected to be approximately $352 million, $26 million higher than last season, assuming that production levels from last season are maintained.

Strength in prices for beef and lamb alongside forestry are also important contributors in supporting strong income growth in the region.

“Manawatū has a greater share of the national sheep flock and beef cattle herd than it has of the national dairy cattle herd,” says Andrew Burtt, Beef + Lamb New Zealand’s Chief Economist.

“As of 30 June 2020, Manawatū District had an estimate of 981,000 sheep and beef stock units, around 65,000 in Palmerston North and equating to a total of 1,046,000 and an estimate of 2.5% of the country’s 42 million sheep and beef stock units,” adds Burtt.

The outlook for commodity prices of agrifood goods produced regionally is strong and expected to add substantial support to the economic performance of the region throughout 2021.

Overview

The latest quarterly economic report underpins the regions rapid rate of recovery and, with the record level of infrastructure investment planned and underway in the next decade, Manawatū is taking strides to regain and grow from COVID-19.