Manawatū region continues to outpace the national average across several key economic areas. Highlights from the quarter include growth in economic activity by 2.9% compared with 2.6% nationally, in addition to electronic card spending growing by a solid 8.8% compared with 7% nationally. With inflation at 7.2% per annum however, annual spending growth of 8.8% has been mostly driven by price rises with a small increase in real underlying spending.

Employment growth is also worth mentioning, with an increase of 2.6% in conjunction with unemployment edging up 2.8% – still one of the lowest rates on record. Particular sectors where job gains were made were notably construction, retail and financial services. Nationally, New Zealand’s employment and labour force participation rates sit at their highest level ever in the September 2022 quarter.

CEDA’s Chief Executive Jerry Shearman says, “Our economic performance remains healthy and resilient, and continues to compare well to the national economy. Jobs in the region also maintain an increase and there is high demand for roles across all sectors, particularly in vocational roles within the region.”

The expectation for the upcoming December quarter is that both employment and earnings growth will remain elevated across the region.

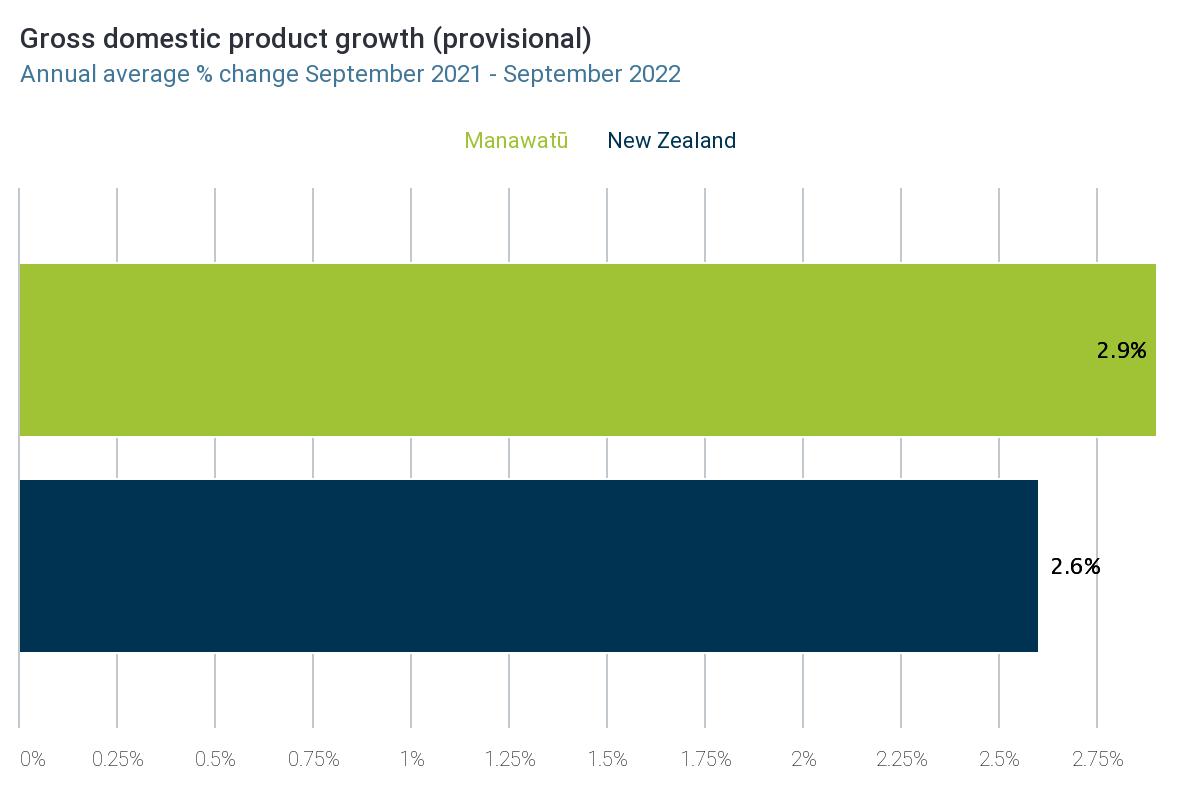

GDP

Manawatū’s economy pushes on showing continued strength following the June 2022 quarter and now into the September 2022 quarter. GDP was up 2.9% compared with the year earlier and higher than the national average figure of 2.6%.

Stacey Bell, City Economist at Palmerston North City Council notes that high employment and rising incomes are continuing to fuel economic activity across the region.

“The fact our consumption levels are holding up, reflects that people are employed and have money to spend. However, the impact of sharply higher interest rates is expected to flow through to retail spending in 2023.

“On the upside, weaker spending across the economy is necessary to bring inflation back under control, supporting a lower peak in interest rates for businesses and households.

“The heightened investment flowing into our region is expected to support job numbers and earnings across the region as the domestic economy weakens into 2023,” says Bell.

Electronic Card Retail Spending

Consumer spending in Manawatū continues strongly ahead of the national average – 8.8% and 7% respectively, as measured by Marketview.

For the quarter ending September 2022, total electronic retail card spending in the region was $422 million, an increase of 17.2% from Sept 2021 quarter. Electronic card retail spending in New Zealand was $17,840 million, an increase of 22.8% from the September 2021 quarter. The breakdown is as follows:

- Palmerston North city – $354 million (17.1% increase from the Sept 2021 quarter)

- Manawatu district – $68 million (17.3% increase from the Sept 2021 quarter).

There was a double digit increase of retail spending during the September 2022 quarter compared to the previous year. This is mainly due to:

- Comparison with the September 2021 quarter which experienced higher levels of COVID-19 restrictions. The region, like most parts of New Zealand went from Alert Level 1 to Level 4 on 18 August, and later moving down the Alert Levels before the nation switched over to the traffic light system.

- Price increase as the result of inflation. The annual inflation rate for the September 2022 quarter compared to the same quarter in 2021 was 7.2%.

The largest sectors for spending in the region in the year ending September 2022 were:

- Groceries and liquor – $578 million

- Home and recreational retail – $448 million

- Fuel and automotive – $311 million

- Cafe, restaurants, bars and takeaways – $201 million

You can view the full Quarterly Electronic Card Spending report for September 2022 here

Employment

Employment* for residents living in Palmerston North and Manawatū district was up 2.8% for the year to September 2022, compared to a year earlier. Growth has been lower than the rest of New Zealand, with comparative 3.1% growth.

Wendy Carr, CEDA’s Talent and Skills Senior says the tight labour market is at the forefront of many businesses’ minds.

“There have been gains in the construction sector workforce partly due to a small shift of sole traders and SME owners moving back to employment,” Carr says.

* Employment (place of residence) data is based off a range of Stats NZ employment datasets, and represents the number of filled jobs, based on the area of residential address for the employee (rather than workplace address).

Tourism

Total tourism expenditure in Manawatū increased by 6.6% in the year to September 2022, compared to a year earlier. This compares with an increase of 3.3% in New Zealand.

Total tourism expenditure was approximately $322 million in Manawatū during the year to September 2022, which was up from $302 million a year ago.

CEDA’s Destination Development Project Manager Janet Reynolds says as we are looking forward to heading into a stronger summer season.

“Off the back of our recent quirky Manawatū Version 2.0 campaign launch, we are looking forward to heading into a stronger summer season. The campaign is set to inform potential visitors about what’s on offer in the region, showcasing all the new foodie, adventure and luxury experiences that can be found here.”

“It’s great to see the annual growth in tourism expenditure we’re seeing for the region, comparative to the rest of New Zealand. This shows continued interest and growing potential for the Manawatū, and our reinvigorated events season will further add to this growth” says Reynolds.

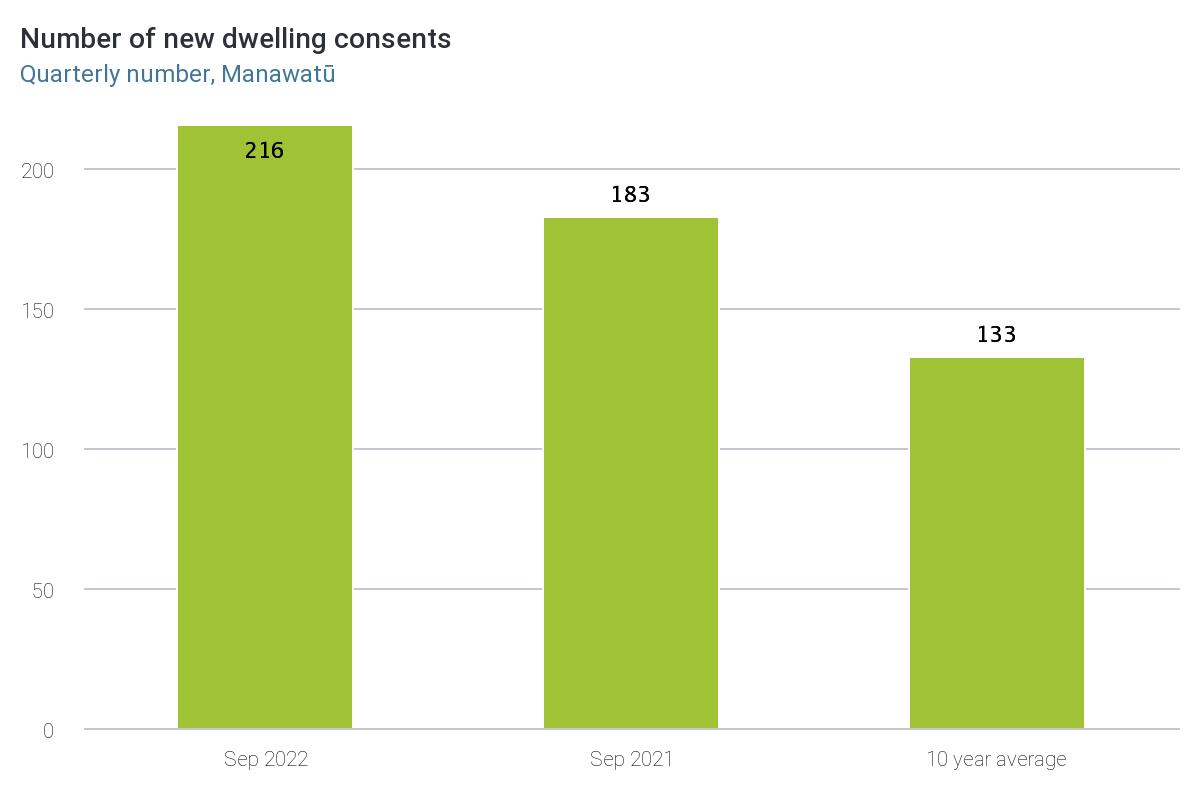

Residential Consents

A total of 216 new residential building consents were issued in Manawatū in the September 2022 quarter, up 36% from the previous June 2022 quarter and compared with 183 in the same quarter last year.

On an annual basis the number of consents in Manawatū decreased by 9.1% compared with the same 12-month period a year before. This compares with an increase of 14.4% in New Zealand over the same period.

Dwelling consents in the region peaked earlier than for many parts of the country with a record 817 new dwellings consented over the year to December 2021. While the number of new dwelling consents has fallen, dwelling consents to June 2022 remain at five-year average levels with 656 new dwellings consented over the year.

The 216 figure of new residential building consents surpassed 200 for only the fourth time since 2012, yet despite this, consents decreased by 11.2% in the region, compared with the same 12-month period a year before. This compares with an increase of 7% in New Zealand over the same period.

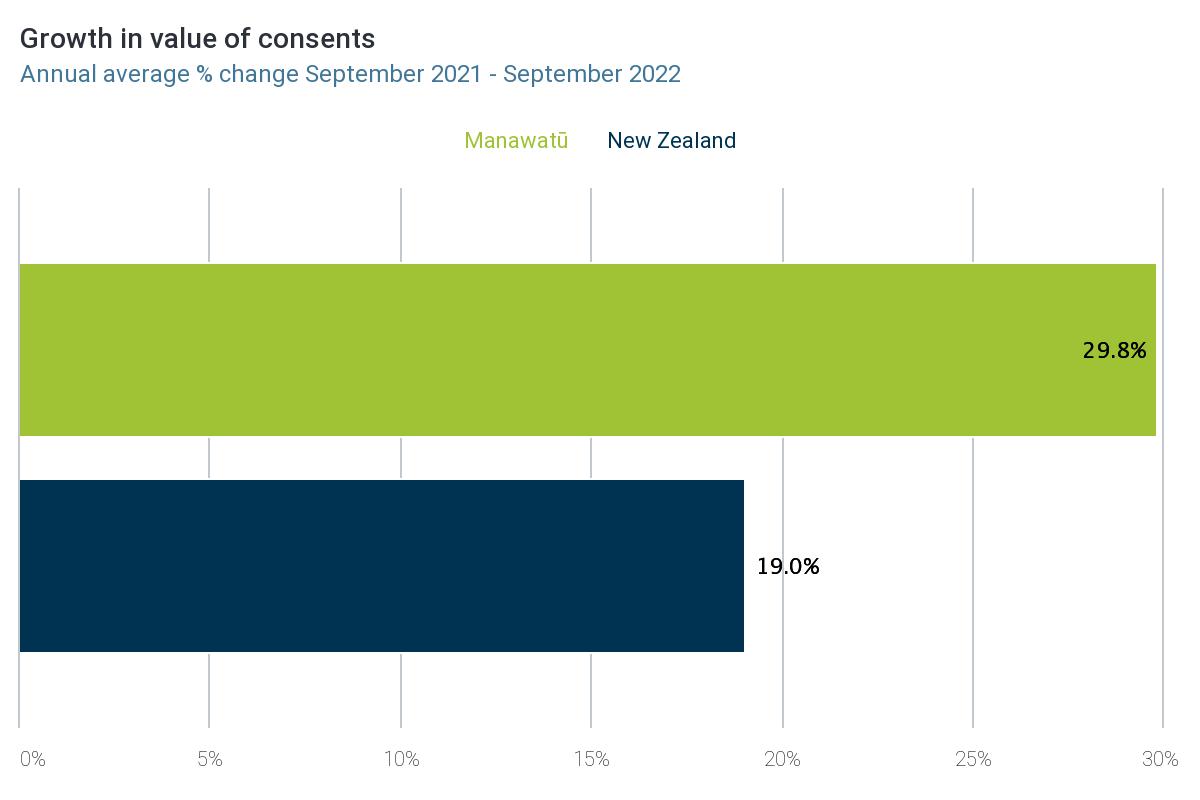

Non-Residential Consents

Non-residential building consents to the value of $256.9 million were issued in Manawatū during the year to September 2022.

The value of consents in Manawatū increased by 29.8% over the year to September 2022, compared to a year earlier. In comparison, the value of consents increased by 19% in New Zealand over the same period.

For year ending September 2022, this is the highest peak in the last 10 years for non-residential consents, thanks to the significant infrastructure and construction pipeline underway and record levels of investment in the region.

House Sales

House sales in the Manawatū region continue their decline off the back of their peak in 2017. For the September 2022 quarter, the regions house values fell 7% compared with the national average of just 2.0%.

A total of 1,640 houses were sold in Manawatū in the 12 months ended September 2022. This is a comparative reduction from the ten-year average of 1,876.

Jason Hockly, QV Property Consultant says, the de-acceleration of the market has slowed in the last couple of months, now roughly around -10% effective per annum.

“This was due to interest rates holding steady for an extended period in Spring. However, with interest rates recently starting to lift again this is likely to precipitate further reductions as we lead into the end of the year and the start of 2023.

“Overall, we are roughly $120,000 back off our November 2021 peak, while still roughly $70,000 off from the 90th percentile of affordability,” says Hockly.