Resilience remains the key theme for Manawatū with the economic forecast looking positive if current trends are anything to go by. Highlights for this quarter include high commodity prices for goods produced in the region, strong consumer spend, employment growth and a hot housing market coupled with a rise in residential and non-residential consents, with no sign of this slowing down.

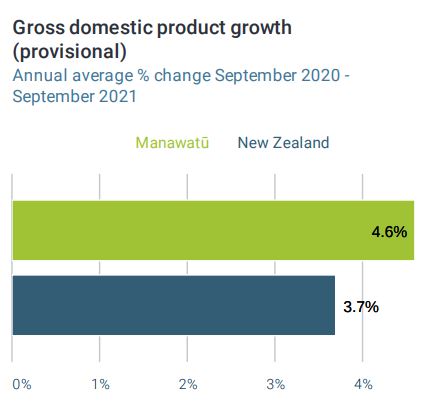

GDP

Economic activity continues to rise in the region with estimated annual GDP increasing by 4.6% in the year ended September 2021. In comparison, New Zealand GDP is estimated to have increased by 3.7% over the same period.

On the contrary, GDP declined by 2.6% in the September quarter, while GDP for New Zealand is estimated to have declined by 3.7%. This however was anticipated because of the impact of tighter COVID-19 restrictions in place from 17 August 2021.

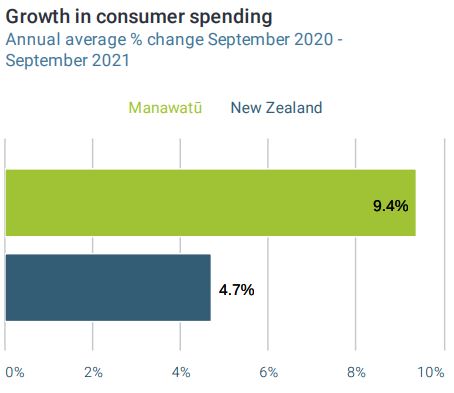

Consumer Spending

Following the trend from last quarter, Manawatū consumer spending remains strong increasing by 9.4% in the year to September 2021 compared to a 6.0% increase across the rest of New Zealand.

Comparing the September quarter however, spending declined by 5.3% in the September 2021 quarter, while national spending declined by 8.0%. Again, this is not a surprise with COVID-19 restrictions in place.

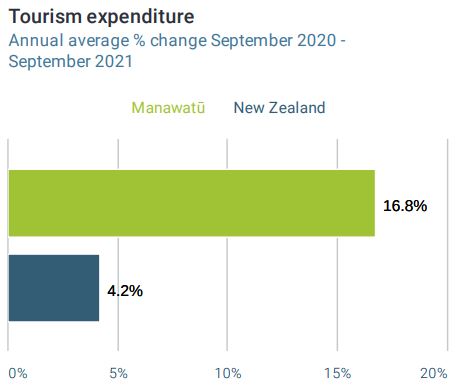

Tourism

Domestic tourism continues to be a valuable contributor to Manawatū’s economy. Due to low reliance on international tourism, and New Zealanders taking the opportunity to explore the regions, Manawatū’s visitor economy has been impacted with much less severity than some of our regional counterparts across New Zealand showing positive signs of continued growth.

Total tourism spend increased by 17% in the year to September 2021 totaling approximately $306 million, up from $262 million a year ago. In contrast, New Zealand expenditure increased by just 4.0%.

Domestic visitor spend was $293 million in the year to September 2021 increasing by 17% from the previous year.

There was a 2.0% increase in domestic tourism spending in the region in October while domestic spending across New Zealand declined by 22.3%. Our central location, strong visiting friends and whanau market, and business travel all help towards this growth in a COVID-19 environment.

CEDA’s Marketing and Communications Manager Janet Reynolds is pleased to see the region bucking the trend, saying “Our strength in the domestic market pre-COVID-19 has set us up well to weather the long-term impacts of the pandemic”.

“The targeted marketing initiatives underway are showing real results as we buck the national trend with an increase to our visitor spending despite the impact on events and travel from the Level 2 restrictions in October”, adds Reynolds.

Overseas card spending continues to increase strongly in the region, increasing by 60.5% from October 2020, while overseas card spending across New Zealand declined by 11.3%.

All eyes are now on how confident Kiwis are feeling to spend and travel over summer, with COVID-19 now in the community and the move into the traffic light system and away from regional borders.

Employment

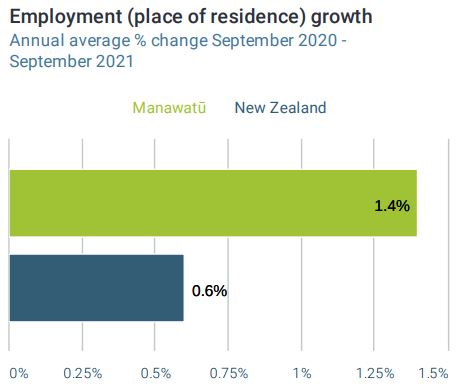

Employment for Manawatū residents was up 1.4% for the year to September 2021 compared to a year earlier. Growth was higher than in New Zealand with say a national increase of 0.6%. This is countered by the impacts on our talent pool, with the labour market remaining extremely challenging for many businesses struggling to fill vacancies to enable business activity to expand and meet demand.

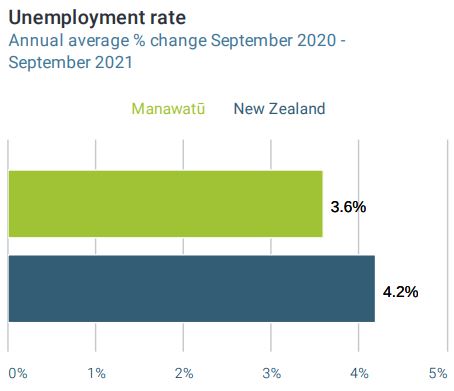

The annual average unemployment rate in Manawatū was 3.6% in September 2021, down from 4.1% 12 months earlier, which is still lower than in New Zealand dropping 4.2% in the year to September 2021.

“While unemployment is down and employment is up this is no time for the region to think our talent and skills shortage challenges are remedied”, says CEDA’s Talent and Skills Manager Sara Towers.

“CEDA is supporting the regions sectors of strength, including the recently launched infrastructure and construction talent attraction marketing campaign launched late November which targets major cities to entice more people to make the move to Manawatū for their career”

“As of June 2021, the Manawatū-Whanganui region had over 4,000 youth (15 – 24 years) as NEET (not in employment, education or training) providing CEDA and stakeholders with a very real opportunity to create innovative solutions that enable youth to gain employment” adds Towers.

Primary Sector

Known as Aotearoa’s epicentre for agrifood innovation the large food based primary sector continues to be a key economic driver in Manawatū, leading to significant opportunities for the primary sector when it comes to innovation, technology and manufacturing.

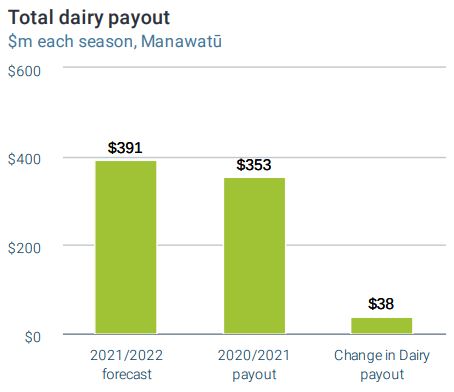

Due to high demand, and limited supply the region has experienced a surge in the predicted dairy pay out, with the 2021/2022 season expected to be approximately $353 million, $27 million higher than last season, assuming that production levels from last season are maintained.

Strong demand and more limited supply have sent dairy prices spiralling upwards. Fonterra has revised their midpoint price to $8.40 – $9.00/kgMS, a record farmgate milk price.

GDT auction results indicate strong returns for our dairy exporters, with rising prices over the latter half of 2021 indicating high returns for the 2022 season.

House Prices

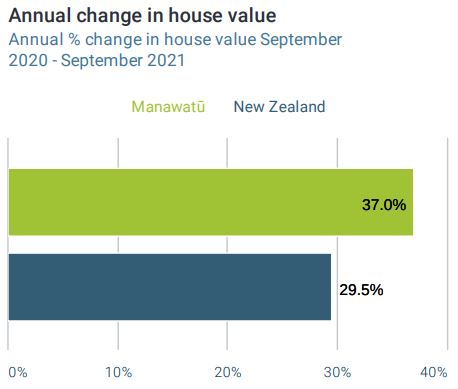

The housing market in Manawatū continues to be hot, however has shown a slight deceleration during the September Quarter and into October and November 2021.

Palmerston North City Council’s Economic Policy Advisor, Peter Crawford says the slowing in prices recently is a positive sign for those looking to buy property.

“Gradual cooling in prices means we are widening the gap between our regional average house prices and the national average.”

“There is some evidence of the market slowing with the number of houses listed for sale in the region increasing strongly providing more room for buyers to negotiate on price”, says Crawford.

In conflict, the average current house value in Manawatū was up an astounding 37% in September 2021 compared with a year earlier. Growth outperformed relative to New Zealand, where values increased by 29.5% nationally. The average current house value was $715,825 in Manawatū in September 2021, compared with $970,174 in New Zealand.

Property Brokers Managing Director Guy Mordaunt says although we have seen a drop in house prices, the market is still competitive.

“Prices continue to rise with records being achieved in most segments of the market and locations and although things are slowing, relatively the number of days on the market are still incredibly fast”, says Mordaunt.

Residential Consents

Manawatū endured another increase in new residential building consents with a total of 183 in the September 2021 quarter, compared with 129 in the same quarter last year. Annually, consents increased by 7.5%.

In terms of values of building consents, there was $398 million in Palmerston North this year an increase of 8% from the previous year, while the value in Manawatū District was $158 million equating to an enormous 60% increase.

Stacey Bell, Senior Economist at Manawatū District Council says record consents for new dwellings in the Manawatū District over the year to September 2021 will help to alleviate housing pressures in the district.

“It is promising to see this level of investment in new homes as we continue to observe double digit house price and rental price increases alongside very strong population growth (+1.6% versus 0.6% NZ YE June 2021)”, says Bell.

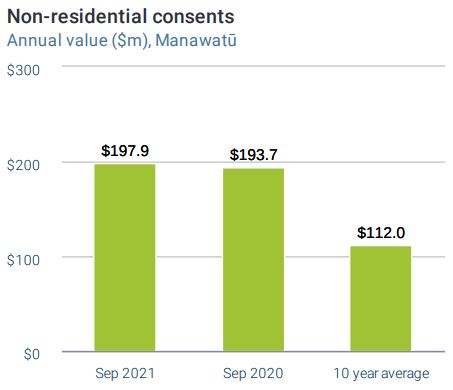

Non-Residential Consents

The flurry of non-residential building consents similarly continues, with a total value of $197.9 million non-residential consents issued in Manawatū during the year to September 2021 increasing by 2.2%. By comparison the value of consents increased by 10.3% in New Zealand.

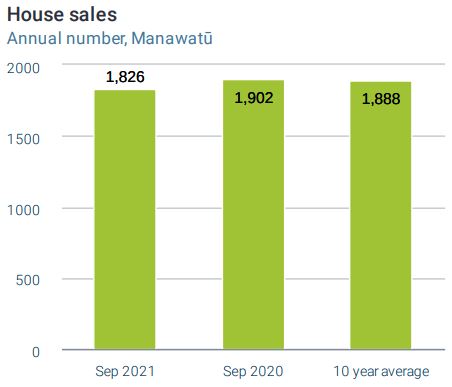

House Sales

House sales in the Manawatū region in the year to September 2021 decreased by 4% compared with the previous year.

Growth underperformed relative to New Zealand, where sales increased by 21.6%.

The softening in sales in recent months sales has been impacted by both a limited supply of housing and COVID-19 restrictions.

Property Brokers Managing Director Guy Mordaunt says, “Lack of supply and low volumes have driven three years of steep house price rises but the recent slowing speed of the market has resulted in more property available.”

Buyers having more selection shows signs of transitioning to a more typical real estate market says Mordaunt, however the supply issues are still a factor.

“Increased lending pressure for the foreseeable future adds further restrictions, particularly for first home buyers. This should slow growth, however that may be offset by the simple lack of housing. It will make an interesting start to 2022”, adds Mordaunt.