Manawatū's GDP was provisionally down 0.3% for the year to September 2024, compared to a flat result of 0.0% for New Zealand overall. Economic conditions remain tough, with the September quarter continuing to reflect the slowing in economic activity. While the region has a number of large industries that are less affected by the downturn in demand, many of our industries are feeling the strain more acutely.

The recent slowdown in construction investment is driven by reduced private and public spending following a period of robust activity from 2020 to 2023.

While investment in larger industries, such as industrial and warehousing, continues, it has notably declined from prior levels. The current market presents and ideal opportunity for construction investment due to spare capacity across the sector. However, the outlook for construction suggests two years of weakness before demand picks up again, largely reflecting the downturn in government spending which is evident in the latest data.

Labour market conditions have softened as businesses shed workers in response to weak demand and rising costs. Government policy is also influencing employment levels, with the recent public sector downsizing affecting private-sector contractors. The Reserve Bank expects Unemployment to peak at 5.2% in the March quarter 2025.

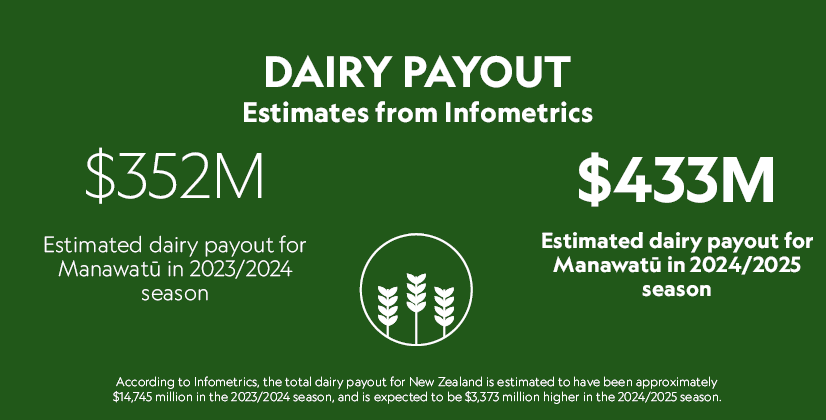

Fonterra's increased forecast milk price of $9-$10/kg offers a much-needed lift for dairy farmers after a challenging 2024 season. While the price signals recovery, broader pressures remain for the agriculture sector, particularly in sheep and beef farming.

Read the full Manawatū Quarterly Economic Snapshot for September here →

Read the full Manawatū Quarterly Economic Snapshot for September here →“The strength of Manawatū's primary sector, along with the region's larger industries that are less vulnerable to downturns in household and business spending, supports its growth prospects over the medium to long term.

While economic conditions are expected to improve in the second half of 2025, tough times persist as consumers and businesses remain cautious."

-Notes Jerry Shearman, CEDA's Tumaki - Chief Executive