The economic performance of the Manawatū region in the year to June 2021 was extremely positive, with GDP growing by 5.4% over the year. Earlier this month, however, the economy was swiftly disrupted as the Delta variant hit our shores putting us into lockdown 2.0. Despite the circumstances, our region can be confident in the fact that during last year’s lockdown our economy was proven to be resilient, and businesses are now better equipped to operate under restrictions. The projected outlook is a similar bounce-back in activity now that restrictions are beginning to ease.

The June 2021 Infometrics Quarterly Economic Monitor shows a further improvement in economic conditions. Driving factors include sustained population and employment growth, strong export conditions, increasing flows of investment into the region, historically high construction activity and a strong recovery in retail expenditure and domestic tourism earnings.

These strengths are countered with the impact of the recent lockdown to economic activity coupled with supply and skills shortage challenges that may restrict growth going forward. However, if we base the future on our strong regional recovery post-COVID-19 last year and current future predictions, the economic outlook for Manawatū is encouraging.

GDP

The latest Manawatū Quarterly Economic Monitor report indicates a 5.4% increase in GDP in the Manawatū region in the year ended June 2021. This compares with an increase of 4.2% in New Zealand. The high level of growth partly reflects the level of recovery from the COVID-19 restrictions during the first half of 2020.

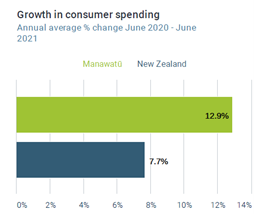

Consumer spend

Consumer spending remains robust with electronic card transactions growing 12.9% in the June 2021 year.

This result again is abnormally strong due to the lockdown-affected June 2020 quarter; however, this does not take away the fact Manawatū’s economy is robust compared to other parts of Aotearoa and is well above the national average.

The strong recovery in local spending was supported by strong population growth and employment alongside our vibrant events scene back up in running in 2021.

Palmerston North City Council’s Economic Policy Advisor at Palmerston North City Council Peter Crawford says growth in consumer spending reflects the confidence of local businesses and households within the region.

“The demand for goods and services produced here has created employment opportunities as well as growing business and household incomes across the region,” says Crawford.

“High spend across neighbouring regions including Whanganui has resulted in spend flowing into Manawatū’ from residents in these surrounding areas,” adds Peter.

With the reduction in alert levels, the underlying strengths of the Manawatū regional economy is expected to drive a speedy recovery in economic activity.

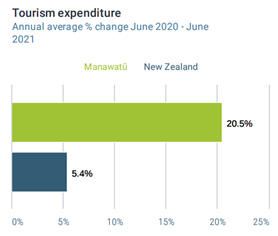

Domestic tourism continues to grow

Manawatū continues to benefit from domestic tourism with total visitor spending in the region $312 million in the year ended June 2021.

Of that, $277 million was spent in Palmerston North, and $32 million in Manawatū, an overall increase of 20.5% from the previous year for the region. This compares with the 5.4% increase in Aotearoa, a positive indicator for the recovery of this sector which was worth $500 million annually for Manawatu pre-COVID-19.

CEDA’s Communications and Marketing Manager Janet Reynolds says domestic tourism in the region climbed exponentially post the COVID-19 lockdown last year, and the recent $1 million dollars of government funding to support the recovery and reset of regional tourism in Manawatū will support our work to support this sector to thrive.

“The news is a welcome boost to Regional Tourism Organisations across the country and warmly welcomed by the team at CEDA who can’t wait to get stuck into supporting the Manawatu visitor economy to grow and thrive in a sustainable and collaborative way.”

“This additional funding will help us to build upon the outcomes our region has already achieved and support the visitor sector to remain sustainable in the future,” says Reynolds.

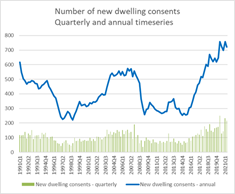

Residential consent numbers drop but remain very strong compared with past figures

A total of 216 new residential building consents were issued in Manawatū in the June 2021 quarter, compared with 251 in the same quarter last year. While this is a 14% decline in the quarterly number of dwellings consents, the June quarter 2020 also had the highest number of consents for new dwellings of any quarter in recorded history.

To demonstrate just how strong consent numbers continue to be, there were 722 new dwellings consented in the region over the year to June 2021 compared with a five-year annual average number of new dwelling consents of just 600.

The year to June 2020 was the first year on record where more than 700 new dwellings consented. This trend has continued over three of the last four quarters. The annual average number of new dwellings consented in the region over four quarters to June 2021 remains elevated at 725.

Non-residential consents continue to rise

Non-residential consents continue to climb sharply, totaling $202 million for the June 2021 year, almost double the 10-year average and an increase of 10% from the previous year. National consents increased by 13% over the same period.

Of this, consents for Ohakea Air Force Base accounted for $27.9 million and 70.6% of total non-residential consent values in the Manawatū District over the June 2021 year. Our current infrastructure pipeline of infrastructure and construction projects now sits at $8billion planned and underway in the next 10 years. This excludes projects valued at less than $50million,

With such high non-residential consents, this raises the question of whether the local construction industry has the capacity to complete the high level of work required – especially with the evident talent and skills shortage within the construction sector.

“We will be soon launching a significant targeted marketing campaign to attract talent in the Infrastructure and Construction sector to Manawatū from around New Zealand,” says Towers.

Employment

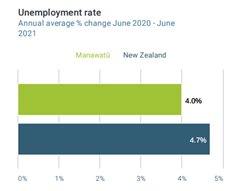

Manawatū unemployment is at 4.0% in comparison to New Zealand sitting at 4.7%.

The strong labour market performance backs up businesses reporting both the most difficult period to find workers, and highest levels of employee turnover on record. Pay increases rose in response, with more pressure on wages expected throughout 2021.

CEDA’s Talent and Skills Manager Sara Towers says the recent figures will be of little comfort to employers looking to hire.

“We are hearing from multiple sectors, including technology, food and fibre, infrastructure and construction, hospitality and health, that they have roles they are struggling to fill. An additional challenge is the current immigration settings are not enabling recruiting staff from off-shore.”

“Industries are having to look at attraction and retention of qualified and experienced people. A recent example is UCOL supporting the talent shortage within the hospitality sector by introducing a new blended delivery for the Level 4, New Zealand Certificate in Cookery, in-work,” says Towers.

House values

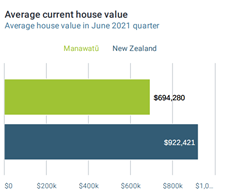

The average house value in Manawatu was up 37.2% in June 2021 compared with a year earlier. Growth outperformed relative to New Zealand, where values increased by 27.3%.

The average current house value was $694,280 in Manawatū in June 2021, compared with an average of $922,421 nationally.

House price growth reflects not only the impact of low interest rates, but also the attractiveness of the region as a place to live and invest, says Manawatū District Council’s Economist Stacey Bell. While this is a positive story, it does have ramifications.

“The increase in mortgage interest rates may help to soften house price growth but will also increase costs of home ownership, placing highly indebted households at additional risk. Vulnerable households within our community will be most affected by the increase in costs associated with housing” adds Bell.

House sales

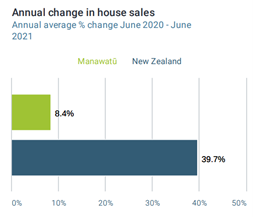

House sales in Manawatu increased by 8.4%, compared to the national increase in sales of 39.7%.

Record low interest rates have encouraged buyers into the market, but rampant sales over the past year have meant supply has been unable to keep up with demand. As a result, in recent months house sales have started to show signs of slowing.

The Manawatū still has a shortage of housing supply relative to the amount of demand says Greg Watson, Director of Watson Real Estate.

“Concerns about the market slowing due to government-imposed changes have not eventuated in our region. Manawatū still ranks very high in the Real Estate Institutes measures of both capital gains and rental yields. Many investors from outside of Manawatu are buying here and the many significant projects happening in our region mean that demand will stay strong, and our median sales prices will continue to grow well, albeit a little slower than it has.”

“While there are fewer buyers currently in the market in this last quarter, multiple offers are still common, keeping the sales prices high. It is important to differentiate between the national figures (which are skewed by Auckland) and regional figures which show Manawatu is outperforming national averages,” says Watson.

Population growth trends

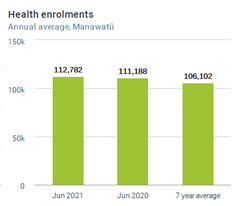

Local indicators continue to imply high population growth such as primary health enrolments which increased by 1.4% to 117,782 over the year to June 2021.

This compares with an increase in national primary health enrolments of 1.3% over the same period. This is reported alongside a substantial reduction in annual net migration figures (4,700 to the year ended June 2021 compared with 84,800 over the June 2020 year). The net migration figures are for NZ and have been driven by border closures/changes to immigration settings for skilled migrants.

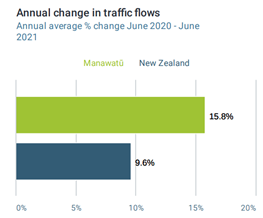

Traffic flows in the Manawatū region in the year to June 2021 increased by 15.8% from 2020, while there was an increase of 9.6% for New Zealand.

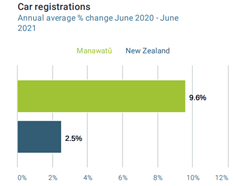

There were 961 new cars registered in the region over the year to June 2021 compared with 829 the previous year. In comparison, national car registrations increased by 2.5 percent over the June year 2021.

“Due to our regions strong sectors, high employment and rapid economic recovery, households have been far less vulnerable to the impacts of COVID-19 and are more likely to spend on high value durable items such as new cars. It is really a testament to the confidence of local workers that their employment is safe relative to many other parts of New Zealand,” says Bell.

The past year has highlighted the strength of the primary sector in rural areas, strong domestic tourism and the ever-increasing economic opportunity and prosperity in the regions. It is anticipated our economy will again remain resilient and recover quickly post the August 2021 COVID-19 Delta outbreak.